B.S./B.A. in Accounting

Get the Accounting Skills You Need Online To Prepare for Licensure Exams

IACBE Accredited

CPA Exam Prep

Pair With MBA for CPA Licensure

Learn More Today

Complete the form to learn more about this program.

- Duration 4 years

- Cost per Credit $329

- Credit Hours 180

Program Benefits

- Flexible online learning format

- Seasoned professors with diverse backgrounds

- Generous transfer policy – now accepting applications

- Expert career advice to help with your job search

IACBE-Accredited Bachelor’s in Accounting Program With CPA Exam Prep

Your bachelor’s in accounting from Eastern Oregon University can be personalized to meet your unique needs. Opt for the accelerated option to finish in three years and select specialized coursework in managerial accounting. Earn your B.A. with 8 credits of foreign language, or your B.S. with 12 science credits.

Our accredited curriculum readies you for vital licensure exams in the industry so you can go for the roles that match your interests. If you want to become a CPA, CMA or CEO, EOU’s accounting degree online provides the tools you need to enter an exciting, dynamic field.

With an in-state tuition of $329 per credit hour and Ph.D.-degree industry experts leading your learning, EOU’s degree offers exceptional value for adult learners.

Accreditation

The bachelor’s in accounting online program at EOU is accredited by the International Accreditation Council for Business Education (IACBE). This affiliation represents EOU’s commitment to a quality business education and consistent, continuing evaluation; you can be sure that the accounting program will effectively prepare you for today’s business careers.

Options for Specializing Your Degree

Requirements for the bachelor’s in accounting online program at EOU include a lower-division core plus an upper-division core. Beyond those, you can choose one optional specialized track.

Accounting Curriculum

Core Curriculum

The online bachelor’s in accounting requires a core of courses including lower- and upper-division courses. Lower-division courses give a background in managerial and financial accounting, business communication, business law and macroeconomics.

Upper-division classes explore theory and practice; classes include principles of marketing and finance, taxation, a series of accounting classes, managerial courses and advanced accounting.

After the core is completed, accounting majors can choose from one optional track: certified managerial accounting.

View CoursesHave Credits to Transfer?

The option to transfer credits makes your program more affordable and can help you get on the job sooner. We allow up to 135 credits from previous college coursework to be transferred into EOU. All EOU majors require a minimum of 20 EOU credits.

To see how your credits will transfer, use our Transfer Equivalency tool.

Career Outlook

New advancements in technology have created a growing need for new professionals in a variety of fields, including accounting. The Bureau of Labor Statistics reports high demand for accounting professionals as the field is currently expanding at a rate of 6 percent. At this pace, more than 91,400 new positions for accountants and auditors will be created by 2033.1 The online bachelor’s in accounting program prepares you to take the certified public accountant (CPA) exam while delivering the credential necessary to advance your career or pursue a master’s degree.

Unlock the door to a variety of professional opportunities and embark on the pathway to career success with EOU Online.

Explore CareersProgram Outcomes

- Develop accurate accounting skills and practices

- Understand accounting theory

- Gain leadership and management skills

- Study for a variety of career paths

- Prepare for an MBA or CPA

- Complete a specialty track in managerial accounting

“Eastern Oregon provides a great learning experience. By completing online while working full-time, I was able to accomplish a huge goal of purchasing a home at 19. I have found the degree to be very helpful as I have begun a career in public accounting.”

– Brady Watkins, former student; Meridian, Idaho; Business Administration, Accountancy

Tuition Details

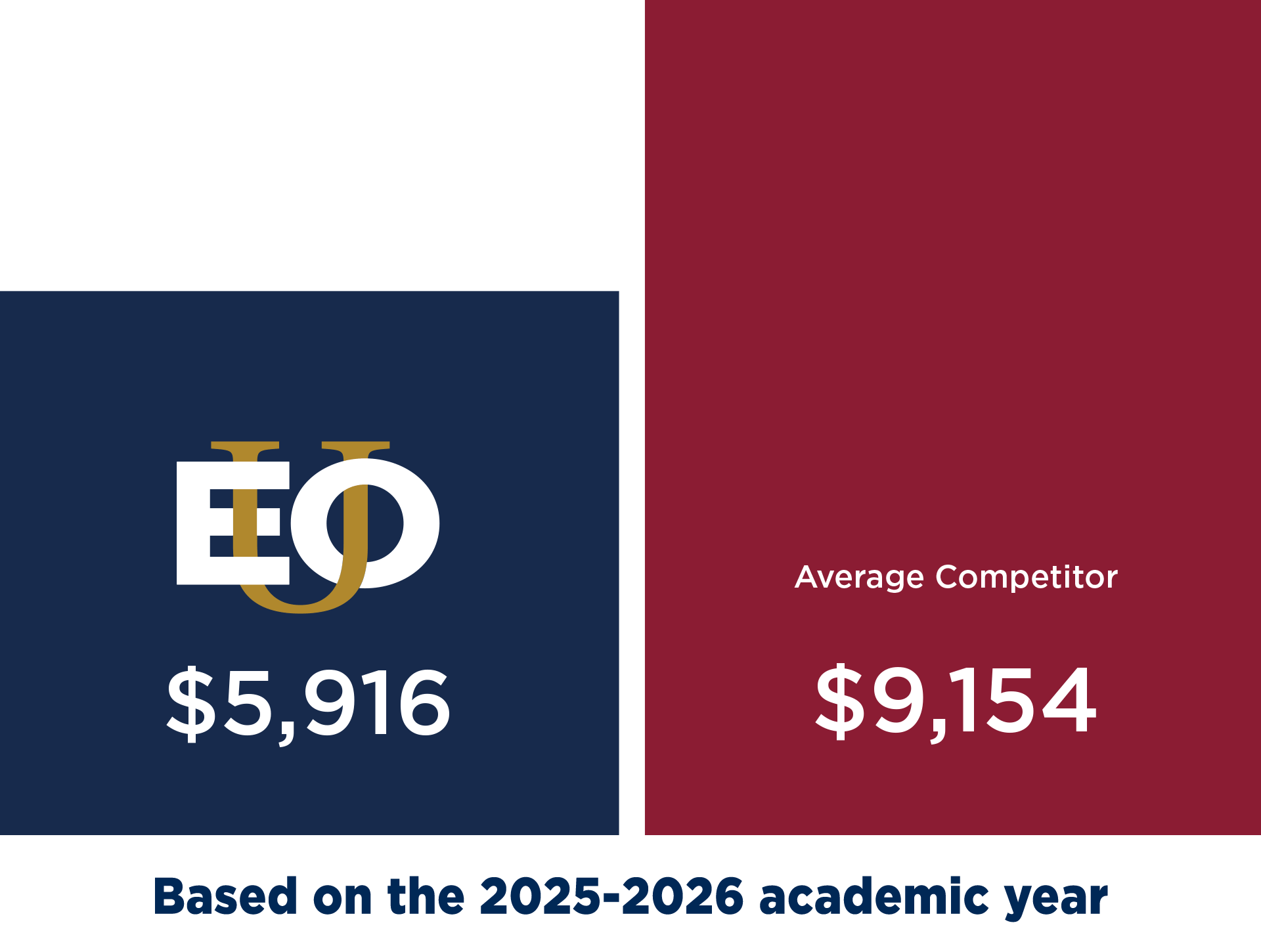

We feature affordable tuition, especially when compared to similar universities. The total cost of your program (assuming no transfer credits) is just over $59,148 with a $329 cost per credit hour. An additional $15.10 per credit hour will be applied to accounting, business, economics and marketing courses.

About 92 percent of our online students benefit from financial aid and scholarships to cover part of these costs.

Based on 2025-26 academic year. Average competitor is based on a sampling of similar undergraduate regionally accredited universities at 18 credit hours per term.

What It’s Like to Study Online

Earning your accounting degree online at Eastern Oregon University is a great opportunity because there are no on-campus requirements. You will have access to the same professors, content and opportunities as on-campus students, only in a creative digital format. Our professors work on campus and are professionals and experts who are trained to deliver innovative, engaging online education.

Online ExperienceTop Recognition for EOU Online

Earn a quality education online from a highly-respected and awarded institution. Eastern Oregon University’s degree programs have received considerable recognition such as Colleges of Distinction, Value Colleges, College Choice and Military Friendly.

Frequently Asked Questions

Here are the answers to a few frequently asked questions about the online fast track accounting program.

The following programs are fully accredited by the International Accreditation Council for Business Education (IACBE):

- B.A.S. in Business

- B.S./B.A. in Accounting

- B.S./B.A. in Accounting: Certified Managerial Accounting

- B.S./B.A. in Business Administration

- B.S./B.A. in Business Administration: Leadership, Organization and Management

- Master of Business Administration

- Post-Baccalaureate Accounting Certificate

The degree consists of 180 credit hours and includes courses in managerial and financial accounting, business communication, business law and macroeconomics. To apply, complete an online application, pay the admission fee and submit your official transcripts along with any other necessary materials.

Yes. The program prepares you to sit for licensure as a certified managerial accountant. A certified managerial accountant is a globally recognized certification.

This program is offered both online and on campus. However, due to the lockstep nature of the program it is highly recommended that students select their desired modality and stick with it through the duration of their enrollment. If a change is necessary, they can work with an advisor. It is not considered a hybrid program because there is no required coursework on campus.

The time it takes to complete your online business degree or certificate depends on the pace at which you take classes and the number of credits you transfer. In general, you can:

- Complete the B.S./B.A in Agricultural Entrepreneurship, B.S./B.A. in Business Administration, B.S./B.A in Economics and B.S./B.A in Marketing in four years

- Take the three-year fast track for the B.A.S. in Business, B.S./B.A. in Accounting and B.S./B.A in Agriculture Entrepreneurship

- Finish the Master of Science in Accounting in two years

- Complete the Master of Business Administration in just 15 months

- Finish the Master of Healthcare Administration in 18 to 36 months

- Complete the Post-Baccalaureate Accounting Certificate in 18 months

The cost per credit is $329, and you’ll need 180 credits to graduate. You can review all tuition costs here.

¹Accountants and Auditors. Apr. 18, 2025. Retrieved June 25, 2025, from https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-1